If you need help knowing how to create a monthly budget, my friend Lauren is guest posting today about her successful monthly budget, how she created it, and even included a free excel monthly budget template for an entire year. Feel free to download and use so your family can create a successful monthly budget too.

When my husband and I did pre-marital counseling there was a whole session talking about finances and budgeting. Our pastor asked all the tough questions, and we jumped straight into the nitty-gritty, answering his questions with all the honesty we could muster.

Since money is one of the top sources of marital discord, it was incredibly important to us to get started on the right path.

How to Create a Monthly Budget

In the month before we were married, we created a monthly budget and an excel spreadsheet to track everything from month to month (which is available as a FREE download at the end of this post!).

So today I’m going to share with you:

- How to create financial transparency.

- How to create a budget.

- How to implement the budget.

- How to actually stick with the budget.

- How to use the excel monthly budget template (FREE to download at the end of this post!)

1. How to create financial transparency

1. How to create financial transparency

First, take the time to create financial transparency!

Creating financial transparency in a marriage can eliminate serious fights over money.

For us, it’s basically eliminated 95% of fights about money.

In order to create transparency, we first shared all of our usernames and passwords and stored them securely using a program called Last Pass. It’s free and simple to use.

For us, sharing our passwords creates a sense of accountability.

With the added dimension of accountability, we both have the ability to check bank accounts and credit card balances at any given time.

Since both of us regularly access our financial accounts, we are less likely to deviate from the monthly budget or fall into the treacherous troubled waters of financial infidelity (i.e. cheating on the budget).

Second, we gave full disclosure of our current financial situation. Debt, bills, savings—all of this was covered in detail with complete honesty.

Third, we also maintain transparency through weekly or monthly financial meetings where we discuss exactly where all the money went.

Every. Last. Detail.

Facing your finances is incredibly brave, and it is not always easy. Think of it this way: a few jabs or punches month by month is far better than the inevitable financial knock-out after months of neglect.

2. How to create a monthly budget

Basically, we looked at our monthly income and broke it down into 3 major categories:

- Necessary expenses

- Discretionary expenses

- Savings

Then we broke each major category into subcategories:

Necessary expenses

- Rent

- Water

- Sewer

- Gas and electric

- Mobile phone

- Cable and internet

- Auto insurance

- Renters insurance

- Car maintenance

- Gasoline

- Kids

- Food—groceries and toiletries

Discretionary expenses

- Cash allowance #1

- Cash allowance #2

- Date night money

- Gift budget

- Christmas budget

- Travel and vacation

- Misc

- Clothing (necessary)

Savings

- Cash savings (emergency fund +)

- Retirement account #1

- Retirement account #2

- College savings for kids

We attempted to choose realistic and reasonable amounts for each category.

When we set up our budget it was the perfect time to talk about our long-term financial goals.

We asked ourselves, “How much money did we want and need for our future?”

This helped us decide exactly how much money to put into cash savings, retirement and a college fund for kid(s) each month.

We also opted for individual cash allowances to use on personal discretionary spending. Cash is great because it allows for a no questions asked policy, which eliminates fighting over discretionary purchases.

If I wanted to buy a $6 coffee from Starbucks, I could, but it came from my cash allowance.

We currently maintain a few rules for using cash allowance. For example, if we opt to buy lunch at work, this comes from our cash allowance. Taking lunch from home is expected. The allowance is usually applied to lunch out at work, activities with friends, or buying items that are not necessary.

We each have a set cash allowance each month to buy what we want. We get the same amount. No fighting over that either.

Everything else in the discretionary categories is usually discussed prior to a purchase. It helps us stay on track, further creates transparency, and encourages accountability.

3. How to implement the monthly budget

Starting on the first of the month is perfect because that is easiest to remember. We withdraw the cash allowances from the ATM right around the first of the month as well. Then we track our spending.

We are both horrendous when it comes to receipts so we opted to charge everything and pay it off each month.

We never carried a balance so interest rates and fees never incurred.

I track and manage the finances throughout the month and calculate all end of month balances. It is usually too time-consuming to track our spending daily, so I usually check on it once a week to see if we are on track.

We make adjustments throughout the month as needed.

Any major expenses that are not in the budget, such as a major car repair due to an accident, comes from emergency cash savings.

Once we were on a budget for several months, I became more confident in our spending habits and I didn’t need to check it as frequently.

4. How to stick with the monthly budget

The first way we stick to the monthly budget is to actually do the excel spreadsheet and track our finances weekly.

Invest one hour every Saturday or Sunday to just add up all the numbers and see how it’s going!

The second way we stick to the monthly budget sheet is to hold weekly or monthly financial meetings.

After I put all the numbers in our excel monthly budget template, my husband and I talk about how much we spent and saved. We look at all of our account balances and purchases together online.

This is also great for accountability. We both know exactly where every single penny is going.

If you truly want a family budget to work, I think collaborating together is the key to success. If I were to manage everything, but never shared anything, it would be all too easy to start sneaking things. We definitely overspend from time to time, but we try to get back on track as quickly as possible.

Also, if you are wary of using a budget, I always say give it a three-month commitment.

Over the course of several months, you will be able to see your savings grow and grow.

It’s absolutely fascinating to see how much we had when we were first married compared to now. We are making huge strides!

I hope that you will find the same success in your family as you begin to create a monthly budget.

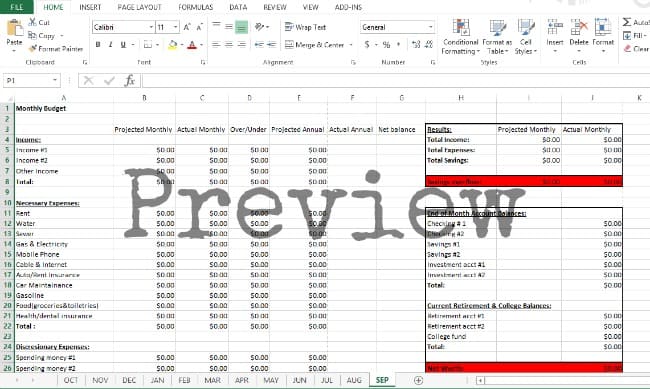

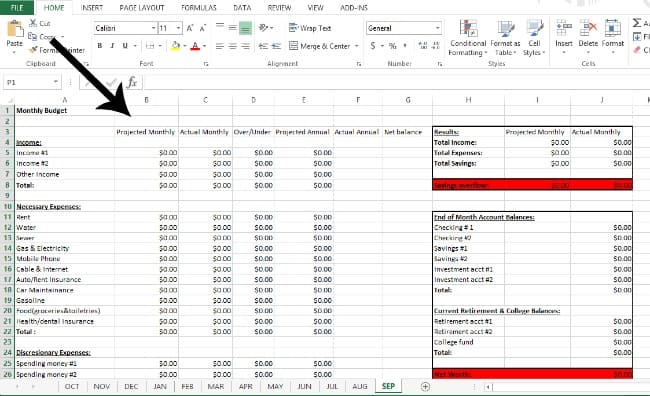

5. The Excel Monthly Budget Template

This is the exact monthly budget excel spreadsheet template we use in our home.

It is completely formatted in Excel and contains a complete year’s worth of monthly budget excel spreadsheets. You can simply save the original file and use again year after year.

There are columns for projected monthly, actual monthly, over/under projection, projected annual, and actual annual on each sheet in the monthly budget excel template.

Fill in your projected budget and your actual budget and the rest will auto-calculate! Pretty sweet!

The only column that you will need to manually add is your actual annual income.

You do this by adding up your actual monthly balances month after month. At the end of the year, you can see how amazing you did!

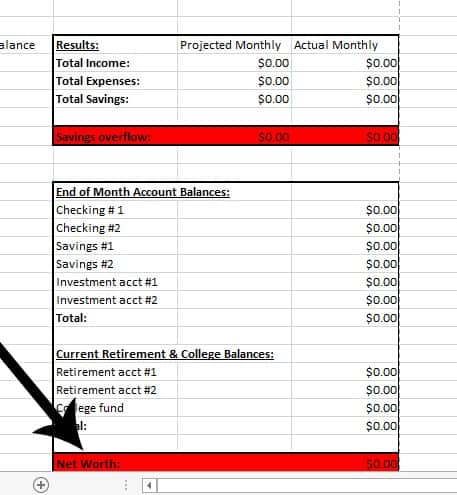

There is also a section where we manually input the end of month account balances. Your NET WORTH will automatically calculate and you can see how much money you really have all together. This is really encouraging to see growth month to month!!

Sign up below to download your FREE monthly budget spreadsheet via Google Docs!

1. How to create financial transparency

1. How to create financial transparency

Brittany Bullen says

Hi Katelyn… and Lauren? Was this a guest post? I think maybe it was… not sure though.

Either way, this is great. Budgeting is really tough for us because I’m awful at sticking to it, but there is one thing I’ll definitely take away from this– LastPass! I’m signing up for it now. I need it!! So thank you!

Brittany

Katelyn Fagan says

Brittany – Yes! This was written by Lauren, because I am not great at sticking to a budget either…. but because my husband is a spender. lol. And you are welcome from both of us for the advice!

Lauren Tamm says

Glad you enjoyed it BB 🙂

Katie says

I love how clearly you spelled out budgeting. Thanks for the advice!

Ashley Pitts says

Hi katelyn!

Awesome article. Do you have a formula for the spread sheet? Or how it auto populates?

Thanks!

Katelyn Fagan says

My friend Lauren made the excel document. Most of it has it autopopulate the formulas for you, but I did notice in her download (which I downloaded myself and now use) that some things weren’t populated, or weren’t correctly. We’ve been able to make the necessary changes pretty easily. But, I do have an Excel pro husband. 🙂

Patti Green says

I am definitely interested in starting a monthly budget. Where is the download for the free excel documents?